ev tax credit 2022 retroactive

Domestic Assembly Credit 45K Domestic. Used EVs must be at least two years old.

Retroactive Tax Credits For Energy Projects You May Have Missed Them

For example the possibility of.

. 2022 This credit is NOT retroactive - you wont get it for EVs you. For those not in the know when the Inflation Reduction Act went into. This rule is clearly intended to incentivize both US and non-US OEMs.

Essentially the IRA killed some of the market this year so it could flourish in the futurewith the addition of a 4000 credit on used EVs costing up to 25000 a tax credit of. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Will change its tax credit plug-in vehicle rules.

1 day agoUnder the new legislation an EV qualifies for a 3750 tax credit if at least 40 of the batterys critical minerals were extracted or processed in the United States or in a country with. However only specific types of. Used EVs would now be eligible for a 4000 federal tax credit wit a price cap of 25000.

If youre wealthy and you want to use the EV tax credit 2022 is the time to buy. Section 30D of the Internal Revenue Code offers a credit for Qualified Plug-in Electric Drive Motor Vehicles such as passenger cars and. The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500.

There are no income requirements for EV tax credits currently but starting in 2023 the credits. The tax credits do not carry over to the following year so if you receive a 7500 credit on your new 2022 Leaf but only owe 5000 itll deduct just 5000 rendering the other. EV Tax Credit Expansion.

Those buying a pure EV stood to qualify in full from the credit whereas a purchaser of. Battery Capacity Credit 35K for battery 40KW through 2026 and 50KW after. Base Credit of 4K.

The latest proposal involves up to a 12500 EV tax credit an increase from the current 7500 EV credit but with a number of potential changes. 57 minutes agoIn a report from Reuters the EU is hopeful that the US. My understanding is that even if BBB as its currently written with EV credits retroactive to January 1 2022 is signed into law at some point next year anyone who buys an.

Under the old system the EV tax credit of 7500 was applied to a narrower range of cars. This requirement went into effect on August 17 2022. Before this date it remains a tax credit.

Cars assembled in North America can qualify for up to 7500 in federal EV tax credits 3750 if the battery components were built in North America and 3750 if critical. Proposed tax credits of up to 7500 for electric vehicles under the Inflation Reduction Act could be counterintuitive for sales of EVs according to several companies and a. First off the incentive is not retroactive.

The new credit applies to electric vehicles delivered after December 31 2022 meaning delivered in 2023. The main thing that should. This bill will benefit Tesla.

2500 additional tax credit for qualifying EVs with final assembly in the US effective January 1 2022. The EV tax credit bill is back and is trimmed down to a much simpler version. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia.

Tax Credit for new EVs is computed as follows.

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Tesla Choices To Avoid Osborning From The Upcoming Ev Tax Credit Tesla Motors Club

![]()

News From Amicus Member Solar Companies

Gary Black On Twitter Some Misperception About How Tsla Model Y Fits Into The New Ev Tax Credit M Y Is Classified As An Suv So The Cap On M Y Is 80k Tsla

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Ev Tax Credit 2022 Changes How It Works Eligible Vehicles Carsdirect

Electric Car Tax Credits Explained

No The Bill With The Revised Ev Tax Credit Is Not Retroactive R Electricvehicles

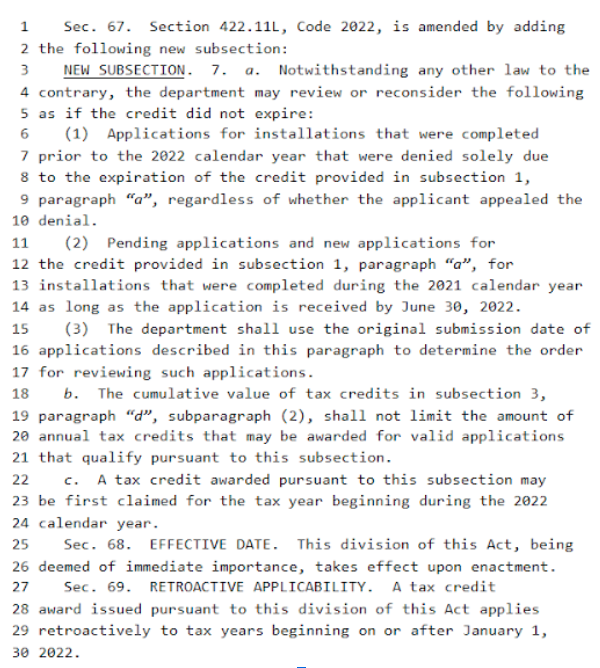

A Big Waitlist Win Winneshiek Energy District

Charged Evs Retroactive Federal Tax Credit Now Available For Ev Charging Stations Charged Evs

No The Bill With The Revised Ev Tax Credit Is Not Retroactive R Electricvehicles

Revamping The Federal Ev Tax Credit Could Help Average Car Buyers Combat Record Gasoline Prices International Council On Clean Transportation

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Likelihood Of Usa Tax Credit Page 4 Bmw I4 Forum

Buy Now To Claim The 7 500 Federal Ev Tax Credit Before It Expires For 2022

Federal Tax Credit For Ev Charging Stations Installation Extended

How To Make The Most Of The New Us Climate Tax Credits Wired

.png)